Advanced Thin Film Solar Power Technology Used in Aerospace and by NASA, Industrial/Commercial Construction and Many Consumer Goods; Reaching Record Power Generation Milestones: Ascent Solar Technologies, Inc (NASDQ: ASTI).

New Critical Funding Under way for $ASTIFor more information on $ASTI visit https://www.ascentsolar.com .

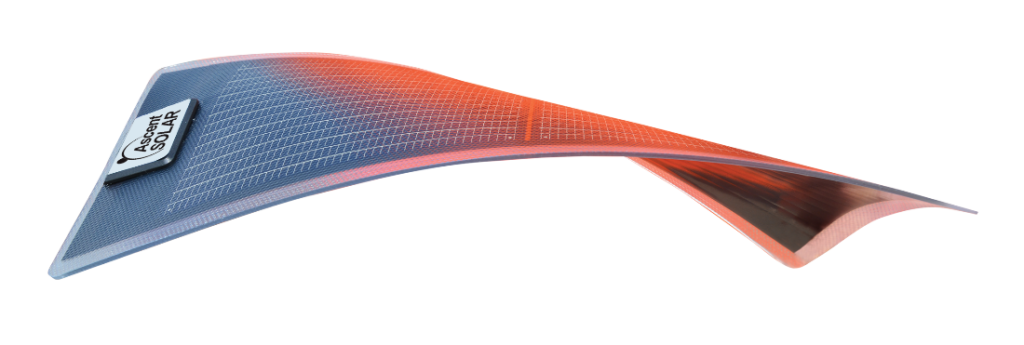

Leading Provider of Innovative, High-Performance, Flexible Thin-Film Solar Panel Technology.

Specific Applications in Environments Mass, Performance, Reliability, and Resilience are Key Considerations.

40 years of R&D, 15 years Manufacturing, Numerous Awards, and a Comprehensive IP and Patent Portfolio.

Products Used in Space Missions, Aircraft, Agrivoltaic Installations, in Industrial/Commercial Construction and Extensive Consumer Goods.

2024 Public Offering Launched for up to $6 Million Cash Infusion.

Thin Film CIGS Technology Reached Record Power Generation of 14 Watts at Production Scale with Thin Film.

Substantial Debt Reduction and Plan for Full Payoff.

Ascent Solar Technologies, Inc (NASDQ: ASTI) is backed by 40 years of R&D, 15 years of manufacturing experience, numerous awards, and a comprehensive IP and patent portfolio. ASTI is a leading provider of innovative, high-performance, flexible thin-film solar panels for use in environments where mass, performance, reliability, and resilience matter. ASTI photovoltaic (PV) modules have been deployed on space missions, multiple airborne vehicles, agrivoltaic installations, in industrial/commercial construction as well as an extensive range of consumer goods, revolutionizing the use cases and environments for solar power. The ASTI research and development center and 5-MW nameplate production facility is strategically located in Thornton, Colorado.

ASTI Announces Pricing of Public Offering for up to $6 Million Cash Infusion

On April 10th ASTI announced the launch of a “best efforts” public offering of gross proceeds up to $6 million at a price of $0.14 per share of common stock. In lieu of Shares, investors can purchase one prefunded warrant to purchase a Share. The prefunded warrants are immediately exercisable at a price of $0.0001 per Share and only expire when such prefunded warrants are fully exercised. Dawson James Securities, Inc. is acting as the exclusive placement agent for the offering.

CIGS Technology Power Generation Milestones at Production Scale with Thin Film

On Match 25th ASTI announced that its thin film CIGS technology reached record power generation of 14 watts at production scale.

Since the installation of new leadership in April 2023, ASTI engineering and production teams have focused on improving their processes and chemical formulation, resulting in continuous increases in power generated from its innovative thin-film PV. The first in a series of milestones was initially announced on September 5, 2023, with subsequent improvements shared at regular intervals.

Using the AST Titan™ module to illustrate improvement, CIGS technology has steadily increased its power generation capabilities over the past seven months. The ASTI Titan™ module is approximately one square foot in size with a thickness of 0.03mm and a weight of just over eight grams.

Below are the recent calculations for power generation* at ASTI Titan™ module dimensions:

| • September 15, 2023 | 11.6 watts |

| • October 30, 2023 | 13.1 watts |

| • November 16, 2023 | 13.3 watts |

| • March 20, 2024 | 14.0 watts |

Note: Power generation figures reflect STC conditions and AM0

ASTI anticipates reaching its next milestone of 16 watts output for the Titan™ module in the near term. The increases in power generation for its CIGS PV technology align with ASTI strategy and revenue goals for 3rd and 4th quarters 2024 and 2025, meeting the technological needs for ASTI customers in space to achieve end of life power.

Substantial Debt Reduction and Plan for Full Payoff

On March 21st ASTI provided a corporate update on the Securities Purchase Contract with two institutional investors previously disclosed on December 19, 2022.

It was reported that one institutional investor’s notes payable and related liabilities have been completely paid out and the remaining investor has been substantially paid off with an approximate remaining notes payable balance of $6,700 and an approximate $200,000 of payables outstanding. It is ASTI management’s intention to pay all remaining balances with this institutional investor upon completion of the next equity raise.